Conservation Easements

Colorado’s “Legalized” Theft

Governor Hickenlooper’s Administration

“Fraudulently Fleecing Landowners”

Share

This Article

Share

This Article

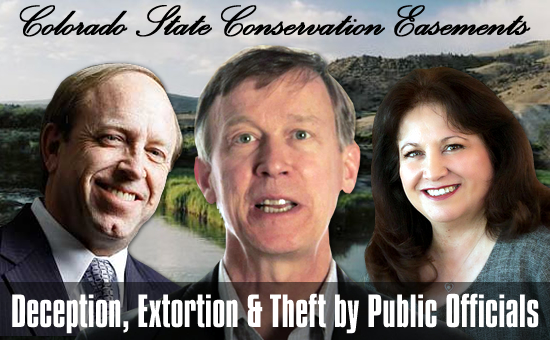

Colorado Attorney General John Suthers, Governor John Hickenlooper, and Dept. of Revenue Director Barbara BrohlBy Lorne Dey & Ron Lee

Investigative ReportersColorado – Imagine you use a licensed tax preparer to file your federal income taxes, just as you have for the last 10 years. Using standard lawful deductions, you have always gotten some money back or at least reduced your taxes. The economy crumbles and Congress re-writes the tax code. You subsequently receive a letter from the IRS that states you are responsible for paying back all of the money you have received over the years (resulting from deductions), plus multi-years’ worth of interest and penalties. Crazy? You would think...

Now imagine that it is a state land scheme you are dealing with and your property, previously appraised at highest and best use for Conservation Easement purposes, has just been revalued by the state (who has no authority to do so) at ZERO and you are being ordered to repay tax credits legally given to you over the past years, plus penalties and interest. Welcome to Colorado's Conservation Easement (CE) program. Under the guise of conserving land and natural resources for future generations through CEs, the State of Colorado has abused and bankrupted law-abiding citizens in a bait-and-switch scheme worthy of national attention.

As announced in our last edition, the US~Observer is investigating this “scheme” developed by private attorneys and enacted by the State of Colorado, which lured unsuspecting landowners (farmers and ranchers) into forever encumbering their property with a CE. They did so with the promise that the landowners could legally monetize the development (property) rights of their land, and then many years after the transactions the State of Colorado reneged on the deal and began their extortive tactics. If a common citizen committed the same thing that the state did, it would factually fit the crime of Extortion.

What began as a nefarious strategy for attorneys to obtain Colorado state tax credits for their wealthy clients transformed into an industry, and to enrich themselves in the process, has now caused disasters including bankruptcy, family breakups, and mental, physical, and financial despair for unsuspecting land owners and their state-licensed appraisers, who all followed the law.

Larry KueterThe alleged architect, Larry Kueter, is a Denver attorney who reportedly persuaded Colorado State Representative Lola Spradley, to introduce cleverly designed legislation in 1999 and 2001, that purposely minimized oversight in order to provide lucrative benefits to special interest attorneys, tax credit brokers, and wealthy clients by offering state tax credits for Colorado Conservation Easements.

What is a Conservation Easement?

The term emerged in the 1950s, with the US Congress passing an amendment to the Tax Reform Act of 1976, providing expressed authority for IRS tax deductions for conservation easement donations. A conservation easement isn’t anything like a traditional easement, where a landowner gives permission for a positive restriction to another entity (government, business, or individual), which is the right to make limited use of the property for a specified purpose, duration, and/or designated sum of money (i.e. a buried pipeline, cable, road access, etc.). Conversely, a conservation easement is a negative restriction where the land owner forever restricts the property from being developed (mining, housing, water, etc.), in perpetuity. He or she does so by placing the subject land into an IRS 501 (c)(3)-certified Land Trust, a special nonprofit that is set up to receive these donations and to be responsible for monitoring the entrusted land. The landowner records a CE Deed (restriction) with the respective county clerk and the CE Deed must identify the receiving Land Trust in order to qualify for the authorized tax deductions. The value of the tax deduction is determined by a qualified appraisal, as identified by the federal regulations IRS 170(h).

History

Bill SilbersteinOn the premise of preserving open space and preserving Colorado’s natural resources; Larry Kueter reportedly manipulated Colorado State Legislators to enact a law, to generate state tax credits, with provisions that land owners (CE donors) could transfer (sell) state tax credits to more wealthy individuals. Despite the well-reasoned opposition testimony of Colorado State Representative Douglas Bruce, identifying numerous concerns; (a) lack of oversight, (b) qualifications for appraisers, (c) how are perpetuity values determined, (d) the Department of Revenue’s inability to monitor or examine appraisals, (e) could C/Es be established anywhere 50 miles east of Springfield, Colorado, etc. Larry Kueter reportedly assured the Colorado State Legislature that adding oversight would be cumbersome and that the IRS regulations were self- policing. The legislation passed, with the influential front-range attorneys, land trusts, and tax brokers all elated and ready to rake in lucrative tax deals for their wealthy clients.

Mike StugarReportedly, those directly benefiting from the CE program include Denver Attorneys Larry Kueter and Bill Silberstein, Tax Credit Brokers, Attorney Mike Strugar of Strugar Conservation Services LLC in Boulder CO; Carl Spina of Conservation Tax Credit Transfer LLC; and Marty Zeller of Conservation Partners. According to information received, another very questionable individual is John Swarthout, former president of Colorado Coalition of Land Trusts. Curiously, Swarthout recently joined Governor Hickenlooper’s office, as a policy advisor, and is reportedly heavily tied to oil companies.

The Tax Credit Brokers Control of the CE Business

Up to the point of the legislation passing, cash-poor land owners had little to no benefit in utilizing Conservation Easements on their property. The legislation, however, gave these struggling individuals a way to monetize their property rights, while keeping it in “trust” for future generations of Coloradans – a seemingly win-win scenario.

Carl SpinaThe promoters of the CE program obviously failed to foresee the wide acceptance of participation in the CE program by Colorado farmers and ranchers. And, some of the promoters conspired to create a mess in order to manipulate control. The control, it turns out, was to discredit (destroy) the legitimacy of any appraisal that did not meet the allegedly unscrupulous promoters’ personal criteria and greedy agenda.

In one of the numerous committee hearings held by the legislature, Carl Spina reportedly asserted that he, as well as any of the Tax Credit brokers could determine the validity of any appraisal or easement in a period of 15 or 20 minutes and for any state agency to have that authority would be unnecessary.

The notion that establishing a Conservation Easement and respective state tax credits, was complex, was not lost on the land owners; they expended a great deal of money to hire the appropriate professionals to ensure complete compliance (i.e. state certified appraisers, attorneys, CPAs, wildlife biologists, geologists, etc. – see graphic insert below).

However, when the 1999/2001 legislation passed, the state legislators anticipated approximately $15 million of tax credits to be generated annually, according to the bill sponsors. However, after the Land Trusts wooed land owners across the state with the lure of cash from the sale of tax credits and the good feeling conveyed by the land trusts of doing something for conservation, the state was obligated for more than $265M in tax credits.

At the onset (2003) of the impending controversy, now spanning a decade, J.D. Wright (land owner/CE donor of Olney Springs, CO), was told by a tax credit broker that his CE tax credits were unsellable. Wright then called State Representative Spradley, only to be informed, that all questions should be directed to Larry Kueter. When Wright inquired of Kueter to find out who in state government he could contact for resolution, Kueter reportedly replied, “No one. We designed it (the legislation) to avoid a bunch of bureaucrats looking over our shoulders.”

According to an appraiser who attended a public meeting in Golden, Colorado, Larry Kueter (the influential lawyer and alleged chief architect who developed the Colorado conservation program) told the attendees, “the program was never designed for the ‘hicks’ who farmed and ranched to the south, it was designed to benefit rich Coloradans like ‘John Elway’ who didn’t have enough deductions to give them tax breaks.”

Something had to be done to get these “hick” farmers and ranchers shut out of the CE program! So the reportedly devious broker buddies devised a plan: SCREAM FRAUD and ATTACK APPRAISERS! Thus, in 2004, anonymous calls were made to the Denver Post claiming fraudulent appraisals of conservation easement properties. Newspaper articles suddenly stirred upper echelons of the state agencies (Erin Toll, Director of Real Estate and Roxanne Huber, Director of Revenue). The ruse worked!

Suddenly the state agencies were on a mission, although clueless how to handle the allegations of fraud and/or overvalued appraisals. In light of the recession, and the state’s empty coffers, here was an opportunity to jump on the band wagon with allegations of fraud, in an attempt to solve the state’s budget shortfalls.

To coincide with their destructive strategy, in 2003, the tax credit brokers reportedly developed a union with well-known appraiser, Mark Weston, who in turn enlisted appraisers, Peter Sartucci, Tim Walter, and Kevin McCarty, for the alleged, explicit purpose to invalidate appraisals and to allegedly slander appraisers John Stroh and Bill Millenski (among other appraisers outside of their group). In fact, a public records request revealed an email, dated July 29, 2004, from Janish Wishman, attorney for Great Outdoors Colorado (GOCO), where Tim Walter responded, “I doubt we can overcome the Caldwell and Brown and Stroh water value report but will try.” This followed a reported Wishman and Stroh confrontation a few days earlier over the value of Lower Arkansas Valley Water. Also at this time, Larry Kueter’s son was the lead attorney for the investment group High Plains A&M LLC, which was involved in speculating on irrigation water shares for resale to front range users. The honest appraised value of a share of

Arkansas River water made speculation difficult.In another instance, Mike Strugar reportedly called a state certified appraiser and complained his appraisals were too high. When the appraiser didn’t buckle, Strugar reportedly blew up. Strugar allegedly went on to threaten the appraiser, “I’m going to discredit every appraisal you’ve ever done and I’m going on the offensive right now,” and he did.

Subpoenas were issued, newspaper articles written, and a state grand jury was empaneled. It is important to note that no indictments in the past eleven years were ever handed down against any appraiser or landowner. Colorado Department of Real Estate (CDRE) Director Erin Toll eventually resigned under pressure for making false statements concerning a departmental investigation of state-licensed appraisers. According to a comment on Fox 31 KDVR’s site, “Toll is singularly responsible for ruining the lives of countless INNOCENT people, slandering their names and many who, in several cases, never had a complaint filed against them.”

The Colorado Department of Revenue (CDOR) also had a problem. This state agency had no legal authority to examine the appraisals until passage of HB-1244 in 2005. Since the Colorado statutes identified the IRS treasury regulations - IRS 170 (h) - as the only standards, CDOR then asked the IRS to intervene and to review over 800 CE donations (appraisals). Simultaneously, the CDOR arbitrarily and without any justification sent Disallowance Notices to more than 800 land owners, claiming their conservation easements had $0 VALUE.

How can 800 appraisals, completed by a variety of state-certified appraisers, all be wrong? And, how can any land, anywhere, have ZERO value?

State Representative Wes McKinley asked Philip Horwitz and Mark Couch, the spokesmen for CDOR in 2010, “Why are you (CDOR) refusing to accept second appraisals, that have verified the values of the original appraisal and some have even come in with higher values than the original appraisal? -- There are some cases, where landowners are on their fourth & fifth appraisals, yet you (CDOR) still refuse to accept them?”

CDOR agents Horowitz and Couch reportedly replied, “We don't care if a landowner brings us 100 appraisals, if we don't like them (values), we won't accept them.”

An exasperated McKinley popped up from his chair, threw off his cowboy hat and exclaimed, “You mean to tell me if I have 100 Doctors make the same diagnosis, you wouldn't believe it?”

Some time later, in a legislative hearing, Couch & Horowitz were questioned about the comment. Reportedly, they both lied and denied it was ever said. However three witnesses - Wes McKinley, and two of his constituents (affected CE landowners) David Emick and Jillane Hixson - did indeed, hear the remark.

Clearly Horowitz and Couch were pushing an agenda; however, the following Colorado statue denies Director of Revenue Barbara Brohl (formerly Roxanne Huber) the authority to send those dis-allowance notices without valid proof of her opinion.

Colorado Revised Statute (CRS) § 39-22-103(1) defines the term assessment for the purpose of Colorado income taxes in Article 22. An assessment is either "... the filing of the return as to the tax, penalty, and interest shown to be due thereon ..." or as it pertains to any deficiency in tax, penalty or interest, assessment "means the mailing or issuance of a notice and demand for payment." C.C.R. 201-2: 39-22-103.1 clarifies the statutory definition of assessment and also provides that "[a] notice to a taxpayer that the executive director believes a deficiency exists is not an assessment."

The IRS soon became frustrated with the arbitrary work imposed upon them by the conspiring and incompetent CDOR and for the most part, the IRS accepted the validity and value of land owner’s conservation easements. Incredulously, the CDOR then audaciously refused to accept IRS evaluations even though the Colorado statutes clearly identified the IRS regulations as the only standard.

Eventually, the state legislature appropriated funds for the CDOR to hire review appraisers. These appraisers, whose consultant fees ranged from $7K-$15K per-appraisal, produced CDOR’s (desired-insane) pre-determined outcome of $0 (ZERO) value determinations. This coincided with the brokers’ mission to discredit most, if not all, of the initial values determined by the state-licensed appraisers, who were legally engaged by ranchers and farmers to establish values for their respective CEs.

Ironically, when Governor Hickenlooper’s 2002 conservation easements underwent a similar IRS review it resulted in Hickenlooper paying the IRS $52K in a settlement agreement in 2010, (in the midst of his gubernatorial campaign). Nowhere does it appear that the CDOR questioned the IRS’s determination or sought repayment of Hickenlooper’s state tax credits, reportedly in the range of six figures.

In an effort to reach an equitable resolution of the dilemma for the farmers and ranchers, as well as the CDOR, State Representative McKinley offered a very reasonable bill in 2010. HB1208 – that simply stated the CDOR must produce prima facie evidence of fraud within one year, else the conservation easements be accepted. It was defeated by intense lobbying from the Colorado Coalition of Land Trusts, an alleged front for the brokers and water lobby (special interests).

Instead, HB-1300 was enacted in 2011, after being drafted by the CDOR and the Attorney General's Office, resulting in 674 Colorado State District Court cases. Since then, rather than allow the land owners and their appraisers an opportunity to put their appraisals on trial, it turned into a stimulus package for Denver attorneys, and became too costly for the landowners to actually get before court judges.

County commissioners from the affected counties (Alamosa, Baca, Bent, Crowley, Kiowa, Otero, Prowers, and Rio Grande) presented resolutions to Governor Hickenlooper requesting a moratorium on new CEs, until the train wreck was resolved, particularly considering the state budget could not afford ongoing $30M/year allocations to discretionary CEs, while schools were being closed. Hickenlooper arrogantly ignored the commissioners’ pleas, as he continued to blatantly violate his oath of office.

The STATE’s Extortion and Despotism … and more problems

Below is an excerpt of a letter from Attorney General (AG) John Suthers’ office, sent to landowners throughout the state upon their filing for their respective court cases:

“In determining whether the partial or complete waiver of interest and penalties is appropriate, Revenue will consider both the facts of the underlying CE transaction and the taxpayer’s good faith efforts to settle. This includes a consideration of the taxpayer’s specific conduct with respect to the transaction, level of due diligence, knowledge and level of involvement with structuring the donation and credit claim, and cooperation in providing information requested by Revenue.”

Colorado Governor John Hickenlooper was spared CDOR's abusive treatment on his CEs - Getty ImagesThe state is clearly using extortion/coercion against these landowners and it should be emphasized that Governor Hickenlooper was spared this treatment over his own CEs that he established in Bailey, CO. Reportedly, the 2011 legislation was cleverly devised by CDOR Director Barbara Brohl and State Attorney General John Suthers, and it offered two options:

1. COURT ACTION … spend a fortune in court on certain futile attempts to prevail in four trials mandated by HB1300 legislation: 1) Threshold Hearing 2) Validity Hearing, 3) Value Hearing, 4) Liability Hearing.

2. SETTLEMENT - Landowners soon realized the financial impossibility of trying to compete with the unlimited resources of the CDOR/AG and the unbridled leverage of extortion, especially within the court system of Colorado. But even trying to settle with unreasonable agents of the CDOR/AG has been agonizing for ranchers and farmers. The AG’s office has continued to maintain that if the land owner is willing to concede that his/her land has ZERO value, the CDOR/AG will accept the land owners repayment of 80% - 90% of the original tax credits and the multi-years of penalty and interest will be waived … that is, if the land owner demonstrated “good conduct.”

If and when the land owner succumbs to the CDOR's extortion (to pay back the tax credits); the State of Colorado and land trusts continue to enjoy the land owners’ property rights, in perpetuity, for FREE. This in legal terms is called unjust enrichment or extortion.

What does a person’s conduct or level of due diligence have to do with the validity or value of a CE? For those of you who aren’t familiar with legalized crime, the state is telling hapless landowners – “if you just accept the gross injustice, without complaining, you’ll be spared a decade of interest and penalties.” The state’s extortion attempts quickly positions the landowner, who acted in complete good faith and strictly followed the law, to make a desperate financial decision to abandon pursuing justice on the core merits and principles.

Landowners now agonize between two bad options, either go broke attempting to pay outrageous attorney fees or go broke by extortion. Another devastated land owner described it like this, “it’s like choosing whether you would like CDOR to amputate your feet or both legs.”

The state and its accomplices are violating these landowners on the presumption the public-at-large will never hear their story. The US~Observer is giving these victimized farmers and ranchers a voice, so everyone will know exactly what kind of criminally-minded people are currently running the State of Colorado.

None of the real culprits have owned up to any responsibility; instead, they have left the landowners to endure the entire burden of the mess they created.

The landowners of Colorado deserve justice, because their property does in fact have value, as those seeking to take it know very well.

What is needed is for the Colorado voters to help these landowners by expressing their outrage to Governor Hickenlooper and state legislators, who could have put an immediate stop to this outrageous assault at any time. Call the Governor at 303-866-2471 and let him know that you won’t stand for the State of Colorado’s illegal, unethical and unconstitutional destruction of Colorado’s ranchers and farmers. In this writer’s highly qualified opinion, Hickenlooper is totally negligent and complicit in the abuses contained in this article and therefore, he is guilty of taking part in this outrageous criminal conspiracy.

Further, Coloradans who possess a conscience or any level of honesty and ethics need to make sure Hickenlooper and his cohorts are voted out-of-office in the upcoming election.

If the property owners aren't vindicated, the next piece of property they come after might just be yours...

Editor's Note: Anyone who has information on corruption or wrongdoing by any of the people named in this article is urged to contact Edward Snook at 541-474-7885 or by email to ed@usobserver.com. It doesn’t matter how old the information is – be responsible and call.

Land Owners United (LOU) is an active organization (of land owners & tax credit buyers), who has tenaciously sought, and continues to seek, remedy for all who were adversely affected by the injustice of the Colorado government agencies, as described above. If you would like to join their cause to pursue justice publicly and in the federal courts, please contact this exemplary group of individuals. Donations are being accepted at the following address:

LAND OWNERS UNITED

15465 County Lane One

Olney Springs, CO 81062

landownersunited@gmail.com

Subscribe to the US~Observer News Flash Alerts!

Subscribe

to the US~Observer |

The US~Observer believes in our country, our constitution, and the public right to adequate representation. The

US~Observer is If you would like to make a donation to the cause, it can be sent to: US~Observer or you can click here: |

Get

a subscription to US~Observer delivered

right to your mailbox via first-class mail!

Click Here for more information