Send Those that Harm Your Company Scurrying After Recouping Losses

By Michael Quiel

Investigative Reporter

Individuals are not the only ones at risk of significant losses due to mistaken investments in Ponzi schemes or other scam investments. Flimflammery is everywhere, even in the biggest boardrooms. For instance, hundreds of millions of dollars were lost by investment firms in the Madoff investment collapse, with some companies losing all of their assets.

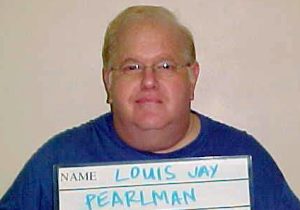

Boy band producer Lou Pearlman, responsible for the Backstreet Boys, NSYNC and others, had the longest running ponzi-scheme in U.S. history. For more than twenty years, Pearlman enticed individuals, businesses and banks to invest in companies that existed only on paper. During that time, he had reportedly swindled a total of over one billion dollars. Eventually, he took a plea deal forcing him to pay back two hundred million – a drop in the proverbial bucket. He later died in prison. Many never received a dime back.

What do you do when you suspect someone is defrauding you or your company, and how do you get investment dollars returned? Simple. You turn to the US~Observer.

The US~Observer will investigate and identify the scheme and originators. Once the evidence of the con is in hand, facilitating repayment can be straightforward. Let’s face it, the biggest threat to a swindler is exposure.

Whether the schemer is an individual or a company, when they go down as a result of their fraud, individuals and companies associated with them may themselves become targets of investigation. Don’t suffer lengthy and costly litigation or reputational damage if you weren’t part of the con, bring on the US~Observer to quickly get to the truth and get you cleared.

Ultimately, the US~Observer is about accountability, and making sure our clients are safe in the market and in their investments.

Has your company been cheated? Contact us today – 541-474-7885.