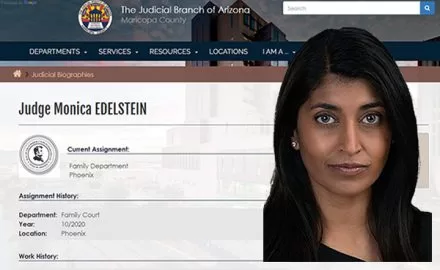

Michael Quiel and his former business partner Stephen Kerr were wrongly convicted in 2013 when their own tax attorney Christopher Rusch (now known as Christian Reeves), IRS Agent Bradly, and Assistant United States Attorney (AUSA) Monica Edelstein created evidence through false testimony during Quiel and Kerr’s trial. This evidence was designed to not only secure a conviction but to also give the IRS the ability to eventually take a second bite from the pair and collect fallacious and exorbitant fines.

Quiel and Kerr’s false conviction in 2013 was for the crime of willfully filing false tax returns; Kerr was also found guilty of failure to file Foreign Bank Account Report (FBAR) forms. In utterly every case of tax fraud, the defendant owes a tax debt. However, at Quiel and Kerr’s sentencing hearing, US Federal Judge Teilborg ruled that the Government failed to prove any tax due, stating, “…the Government has failed to carry its burden of proof by a preponderance of the evidence, much less by clear and convincing evidence, that the tax loss exceeds zero.”

That’s right, they owed ZERO in taxes. Why then would these men have committed a tax crime if there was no tax to be owed? And how could Judge Teilborg sentence these men to prison after finding they owed absolutely nothing? But, Teilborg did. He sent each of them to federal prison for ten months.

The set-up

Tax Attorney Christopher Rusch had been Michael Quiel’s tax attorney and subsequently sought to get involved with Quiel and his partner Kerr, and their company that funded business start-ups. Knowing that they wanted to break into the European market, Rusch approached them with a banking plan. He wanted to start a Swiss bank. Rusch convinced Quiel and Kerr that they would be able to secure European funds for their start-ups and all they would have to do was to become low-level owners of the bank. In fact, the terms were that they were to own so little, US law did not require them to report the ownership. To mirror the business structure Quiel and Kerr used in their U.S. based start-ups they would own 4%. Owning a small percentage could be viewed similar to owning a mutual fund with foreign ownership.

Quiel and Kerr gave Rusch an asset – in the form of stock in various companies – as their investment capital. Rusch took these assets, liquidated them, and used the funds to open his corporate bank. Rusch utilized UBS to facilitate the liquidation and then began the process of opening his own bank.

The small amount of money Quiel and Kerr did receive from this investment was counted as normal income and taxed at the rate of 35%. If they had sold the stock themselves, they would have had to pay a long-term capital rate of 15%. In essence, it would have been in their favor had they sold the stock themselves.

Rusch was the only party with access to the funds while they were in the Swiss accounts which was confirmed by bank officials during the trial. Much of Quiel and Kerr’s money that was in the Swiss banks was never accounted for and is believed to have been stolen by Rusch.

While Rusch turned out to be a scam artist, no one could have expected the US Government forcing UBS into providing names of Americans who were account holders and who could be hiding their funds from the IRS. Quiel and Kerr’s names surfaced, and the government came gunning for them.

Rusch lied, blaming everything on Quiel and Kerr and pleaded guilty on all counts, including a conspiracy charge. Quiel and Kerr were found innocent of conspiracy, the basis for all the charges, but both men were found guilty of filing false tax returns over a two-year period, and as previously stated, Kerr was found guilty of failure to file FBARs. Keep in mind, at this juncture, Rusch had been their tax attorney and therefore responsible for any and all tax filings.

Rusch, who changed his name to Christian Reeves after the trial, continues to offer “foreign investment services” to unsuspecting wealthy clients. Just how many of those clients have been scammed or imprisoned is anyone’s guess – however, the US~Observer has been contacted by several who have been. And, why, if the government knew of Rusch’s propensity toward illicit financial scams, have they continued to look the other way when Rusch breaks the law? Isn’t it obvious? He made a deal.

More than one individual has filed a complaint with the Federal Bureau of Investigation (FBI) about Rusch, now Reeves, conning them and stealing their money. To our knowledge and to the complainants, the FBI has done nothing to hold Rusch accountable. In fact it appears part of the corrupt agreement Rusch made with the IRS when he agreed to lie about Quiel and Kerr at trial is to continue to protect the crooked, snitch lawyer and go after the investors, solely because government thinks they have “deep pockets”.

The government, spearheaded by then Secretary of State Hillary Clinton (who made millions for the Clinton Foundation, and for her husband who made money from speaking fees from UBS), wanted a few lowly convictions to make it appear they were being hard on foreign account “tax-dodgers,” conspired with Rusch to create the crime. They could not admit that this lowly tax-lawyer-cheat was the real villain. They weren’t interested in real guilt only the appearance they were doing what they set out to do. And the prosecution of Michael Quiel and Stephen Kerr goes down as one of the handful of prosecutions to come out of the government’s phony push to expose thousands of “tax cheats” in the Swiss banking system.

The Court’s Hypocrisy

Quiel and Kerr’s conviction has been appealed numerous times all with Judge Teilborg striking them down but not before his own hypocrisy has been exposed. In the same order on July 15, 2015, Teilborg maintains that Quiel and Kerr’s appeal on the grounds there was an undisclosed deal made between Rusch and the government is false because they can prove no deal. He wrote, “Defendants offer no affidavit or other evidence showing that such an agreement exists, and the Government has effectively denied the existence of an agreement, the Court will not hold an evidentiary hearing or grant a new trial.”

However in the same document Teilborg notes, “…the Government does not expressly deny that the reason it has not monitored Rusch’s post-trial activity is because of an undisclosed agreement to not monitor him and grant him leniency in his future dealings. For purposes of this order, the Court has interpreted the Government’s statements as a denial of having any undisclosed agreement regarding future activities with Rusch. If the Government actually has any such agreement, and has artfully worded its representations to not directly address Defendants’ allegations, the Government is ordered to correct the Court’s interpretation immediately and the Court would deem any failure to correct the Court’s understanding to be a fraud on the Court and a Giglio violation.”

One has to wonder what a reasonable person would conclude… Did Rusch have a deal to allow him to regain his passport almost immediately upon release from custody? Or, did he just get lucky? Has the IRS looked the other way when he sets-up fraudulent foreign bank services for others whom he has scammed? Or, is Christopher Rusch’s alias Christian Reeves so good that the government can’t connect the dots?

The US~Observer believes the court knows full and well that there was a deal and that the government won’t ever concede this fact – a fact that, even according to the judge, would be instrumental in overturning these wrongful convictions.

The IRS’ 7-year Grift

The IRS keeps a file on each taxpayer called an IRS Master File (IMF). Quiel and Kerr’s files would have aided in their defense at trial, but Judge Teilborg did not allow for the IMFs to be produced, thereby playing a large role in the fraud in his courtroom. There was quite literally no other evidence that could have proved the men’s innocence at trial than their IMF.

Even after he was convicted, Quiel continued to request his file, and the IRS kept denying him access.

In fact, Quiel’s IMF was withheld until February of 2020. Apparently, that was long enough for the IRS to forget the fraudulent testimony its agents provided seven years earlier regarding the FBAR forms that aided in Quiel and especially Kerr’s conviction, as well as enough time for them to overlook the judge’s ruling that Quiel and Kerr owed no taxes.

The IRS is now seeking MILLIONS in fines and taxes from the men.

As many taxpayers know, what the IRS wants, it gets, or else…

The government conspired to use perjured testimony to falsely convict these taxpayers. Now, after imprisoning them and destroying their businesses, they are seeking to pilfer every last dollar these men have left.

This racket cannot be allowed to continue and the US~Observer will see that it doesn’t.

UPDATE: Kerr’s tax-owed has been dropped as of November 5, 2020. He, however, still faces exorbitant FBAR fines. The IRS still maintains Michael Quiel owes taxes for the years the court determined he owed nothing for, interest and penalties, and his own set of fines.

Both men deserve having never been tried and convicted in the first place, and efforts are underway to obtain a presidential pardon. If the pardon doesn’t work, extreme heat will!