By ALLIN & ASSOCIATES, INC.

Trump’s tax law (passed by Congress in December, 2017) creates some interesting scenarios. Some taxpayers will face an increase in taxes while most will see their taxes reduced. The final three pages of this newsletter will outline WINNERS AND LOSERS from the new laws.

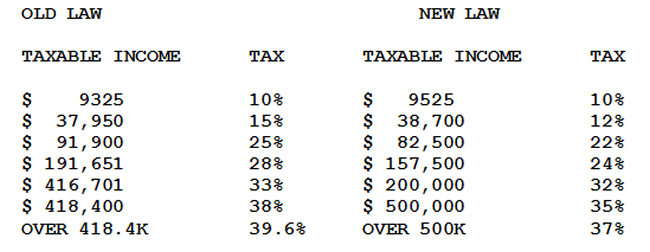

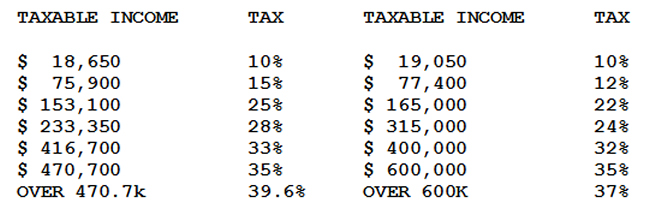

TAX RATES

There continues to be seven tax rates based on the taxpayer’s taxable income. However, in every case, the rates are reduced:

SINGLE OR MARRIED FILING SEPARATELY —

MARRIED FILING JOINTLY —

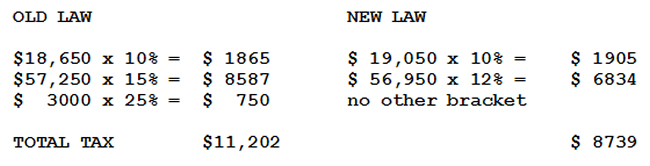

The amount of taxable income for each bracket has gone up slightly, BUT the big difference is the tax rate. For most taxpayers, they will pay three percent less in income taxes. For example, a couple filing jointly with no dependents and a total household income of $ 100,000:

Footnote: some numbers have been rounded off

Footnote: some numbers have been rounded off

Note that a small portion of income under current law falls into a 25% tax bracket, while none does under the new law. The more important feature is the fifty some thousand dollars of income that goes from a fifteen percent bracket to a twelve percent bracket.

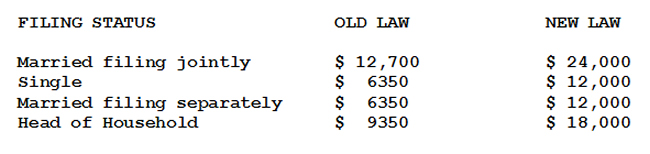

STANDARD DEDUCTION AND PESONAL EXEMPTIONS

These are portions of the new law that will provide the most angst or joy. Current law provides a $12,700 standard deduction for married filing jointly; that deduction doubles to $24,000 in the new law. By contrast, the personal exemption (currently $4100 per person) is eliminated. This will reward small families, taxpayers with no mortgage payments, low medical bills, low property taxes and those who make small or no charitable contributions.

CHILD TAX CREDIT

Current law provides a credit (dollar for dollar) of $1000 for each child under the age 17 provided the taxpayers file jointly and their income is less than $110,000 ($55,000 for single and married filing separately).

The new law doubles the credit to $2000 per child and the maximum income for eligibility jumps from $110,000 to $400,000 for married filing jointly.

STATE AND LOCAL TAXES

The crying and whining from many taxpayers (in high tax States) has been the new limit of $10,000 for State and local taxes. This only affects taxpayers from States with these taxes, AND DOES NOT affect the deduction for sales taxes. State income taxes and sales taxes are deducted on Schedule A (itemized deductions).

I have several observations:

1. remember the State income tax deduction only counts if you continue to itemize deductions; recall that the standard deduction under the new law almost doubles;

2. taxpayers who continue to itemize will be those with high incomes and a large amount of itemized deductions; ordinarily, this means a taxpayer with a large mortgage interest, large property taxes, and perhaps large medical bills;

3. States without an income tax will become more desirable; I would not doubt that a year from now, there will be media reports of an exodus from the States of New York, New Jersey, California and Oregon to States with no income tax (Washington, Wyoming, Texas, Nevada, Florida and others); if your family has total income of $70,000 per year, you pay Oregon about $4000 in income taxes to the State of Oregon;

4. it sets up a small war between the States of Oregon and Washington; the sales tax deduction (Washington) remains, while a maximum tax deduction of $10,000 will now be in place for Oregon residents;

5. there may be pressure on State legislatures to reduce their State income tax levels; Oregon has had a flat nine percent tax rate for about thirty (30) years; California has a step rate system; some Californians pay a 13% tax on their income. Residents of New York City pay not only a State income tax, but also an income tax to the City;

MORTGAGE INTEREST DEDUCTION

Under current law, taxpayers can deduct mortgage interest ONLY on the first 1.1 million of mortgage value. For example, if taxpayer has a three million dollar mortgage, and the annual mortgage interest is $40,000, that taxpayer would only be able to deduct 1.1/3.0 (36.67%) x $40,000 = $13,200 of the total $40,000 paid.

The new law reduces the 1.1 million dollar threshold down to $750,000. However, this new applies only to mortgages written after December 31, 2017, NOT TO EXISTING MORTGAGES.

This new law may spell the death of the HELOC (the home equity line of credit). Unfortunately, many taxpayers think of their home as a savings account. When they need a new car, they simple apply for a home equity loan to purchase that new vehicle expecting to deduct the interest from that loan. In some cases, the taxpayer may not get that deduction anymore.

MEDICAL EXPENSE DEDUCTIONS

Those of us with auto insurance know we chose the deductible on our vehicles. Depending on our choice, the first $100, $250, $500 or $1000 of our claim must be paid out of our pocket before the insurance kicks in.

Unfortunately, we do not have a choice on the deductible for medical, dental and optical expenses. In the 1960s thru mid 1980s, the first 2.5% of a taxpayer’s adjusted gross income would not get a deduction. Only when that threshold was met would the taxpayer get a deduction. In the late 1980s, that 2.5% was increased to five (5.0%) percent. Twenty years later, it was increased to 7.5%, then a few years ago it was increased to ten (10.0%) percent for taxpayers under the age of 50 (remaining 7.5% for those above that age).

The new law changes back to the prior law; that is, the first 7.5% of a taxpayer’s adjusted gross income cannot be deducted (for all taxpayers). This raise of the deductible threshold over the past fifty (50) years from 2.5% to ten percent and now back to 7.5% has most hurt those who:

1. pay their own medical insurance; and/or

2. have large medical, dental or optical bills.

For example, for a couple, one or both of whom work, and have a combined income of $80,000 per year:

1. the first $8000 of medical expenses would not be deductible under current law;

2. under the law of fifty years ago, the first $2000 would not be deductible;

3. under the new law, the first $6000 is not deductible.

To find if they meet or exceed the threshold, a taxpayer must add expenses for:

1. medical, dental and optical insurance;

2. all medical bills, co-pays, hospital, ER;

3. all dental bills; and

4. all optical bills.

CAPITAL GAINS

The law is unchanged. First determine whether the gain is short or long term. If the asset (stocks, bonds, real estate, mutual funds) has been owned for one year and one day, it is long term. The long term rates are zero, fifteen and twenty percent. For a taxpayer in a fifteen percent bracket from his or her other income, that taxpayer MAY qualify for zero tax on capital gains. Most taxpayers will pay the fifteen percent rate. The highest rate is 19.6%. The short term rates are higher.

ESTATE TAX

Most taxpayers would ask themselves “why should I care about others who have five to twenty million dollars of net worth. My answer is: “how much would you like to pay for groceries.”

The taxpayers I believe would benefit from the change in this law are those I call “land rich and cash poor.” The family farmer or rancher. Many farmers and ranchers own tens of thousands of acres in order to produce food. If that taxpayer owns 10,000 acres and each acre is worth $5000, that is 50 million dollars. Nevertheless, that farmer or rancher’s income is perhaps $60,000 per year for all that effort.

Consider that upon the death of a farmer or rancher, they do not have the cash to pay the estate tax. That forces a sale of the farm and ranchland at a public auction. Guess who shows up at the auction? ADM (Archer Daniels Midland), the largest agricultural company in the country. Over the years, companies such as ADM methodically own more and more of our food producing land. Fewer and fewer family farms and ranches, I believe, leads to higher food prices.

Under current law, only those with a net worth above $5.49 million dollars are subject to this tax; for married couples, it is almost eleven million dollars. The top rate for estate (inheritance) taxes was forty (40%) percent.

These amounts double under the new law to $11.2 million for each person ($22.4 million for a married couple). The maximum forty (40%) percent remains.

CORPORATE TAXES

Current law provides a top rate of 35%. In addition, some corporations are subject to an alternative minimum tax, a parallel system of tax that reduces or eliminates deductions and credits in its calculations, leading to a higher corporate tax. The new law provides a maximum rate of 21% and the alternative minimum tax would be repealed.

In response, APPLE has announced it will repatriate some $300 billion dollars of its cash that has been stored overseas for years. Why? Because the company was astute enough to not pay US taxes on its profits until such time as the rate was reduced. That time has come.

PASS-THRU BUSINESS TAXES

Some businesses such as sole proprietorships, S corporations and partnerships, file tax returns, BUT DO NOT pay income taxes. Instead, the profit or loss from that business is passed on to and reported by the owners on their 1040 return. That income or loss is reported like any other income under current law. Under the new law, twenty (20%) percent of any profit will be deducted on their personal tax return provided that taxpayers total income is below $157,500 for single or married filing separately; or $315,000 for married filing jointly.

WINNERS AND LOSERS

WINNERS –

1. CORPORATIONS

With the announced reduction of corporate rates AND the one time amnesty to bring back billions of dollars parked overseas for years, profits will swell for corporations over the next few years AND many companies will hire thousands of new workers.

APPLE announced it will move $300 billion dollars from overseas back to the United States and pay the income tax, plus hire 33,000 more employees

2. CURRENT EMPLOYEES OF LARGE CORPORATIONS

Within days of the announcement of passage of the new law, the following companies announced bonuses for their employees:

ALASKA AIRLINES – $100 for 22,000 employees;

AMERICAN AIRLINES – $1000 FOR ALL 127,000 employees;

AT&T – $1000 for 200,000 employees;

BOEING – $100 million to charities; $100 million to infrastructure;

CAPITOL ONE – raise its minimum wage to $15 per hour

FIAT CHRYSLER – $2000 to 60,000 employees;

JETBLUE – $1000 for all 21,000 employees;

NATIONWIDE INSURANCE – $1000 TO 29,000 employees and increase of 401k matching for 33,000 employees;

OLD DOMINION FREIGHT – $5000 to all 22,000 employees;

PACIFIC POWER & LIGHT – reduction of electric bills to its customers;

SOUTHWEST AIRLINES – $1000 for all 55,000 employees

SUN TRUST BANK – raise its minimum wage to $15 per hour

TRAVELLERS INSURANCE – $1000 for 14,000 employees;

US BANK – $1000 for 60,000 employees, and raise its minimum wage to $15 per hour

VISA – increase its matching to 401k accounts

WALMART – minimum wage of $11 per hour; $1000 bonus, expanded maternity leave; $5000 for adoption expenses

WASTE MANAGEMENT – $2000 to 34,000 employees;

WELLS FARGO – raise minimum wage to $15 per hour and $400 million charitable donation

3. TAXPAYERS WITH NO MORTGAGE OR A SMALL MORTGAGE

The new law rewards thrift. Taxpayers who prepaid their mortgage, or paid extra on each payment and reduced the number of years of that mortgage. No matter the amount of mortgage interest, or no interest, taxpayers are permitted the $24,000 standard deduction.

4. TAXPAYERS WITH SMALL PROPERTY TAXES

Similar to mortgage interest, if you have a $24,000 standard deduction, amounts you pay for property taxes may provide no deduction; therefore, own property with smaller taxes.

5. TAXPAYERS WITH LOW MEDICAL BILLS

Once again, the $24,000 standard deduction must be contrasted with itemized deductions to see which is higher. You may find none of your medical bills can be deducted.

6. RESIDENTS OF STATES WITHOUT TAXES

If you live in a State without State income tax, City and or County taxes, you will benefit. There is a new $10,000 limit on State and local income taxes.

7. TAXPAYERS WITHOUT CHILDREN OR OTHER DEPENDENTS

The trade off for the new $24,000 standard deduction is the loss of the personal exemption of $4100 per family member. Taxpayers with few or no dependents will benefit. For a couple with no dependents, they lose an $8200 deduction for the two personal exemptions, but they gain $11,300 from a standard deduction that goes from $12,700 to $24,000.

8. RETIRED COUPLES

The typical retired couple has these attributes:

a. no mortgage;

b. low property taxes;

c. no medical bills (provided they have Medicare and a supplement or Medicare Plus);

d. Social Security income (partially tax free); and

e. dividend and capital gains income.

These forms of income are tax favored and the housing and medical expenses are less than for most taxpayers.

LOSERS —

1. ACCOUNTANTS

With the new tax bill, fewer taxpayers will need a tax preparer OR accountant to file a tax return. The higher standard deduction is the big curse to accountants.

2. REALTORS AND REAL ESTATE DEVELOPERS

In theory, real estate will suffer. If the major incentive for a taxpayer to purchase their first house is the tax deduction for mortgage interest and property taxes, the new law dissolves this dream. If, however, the taxpayer wants to own a piece of the rock (no landlord, no evictions), and expects a house to build wealth for him or her, that taxpayer would care less about the new law.

3. CHARITIES

Once again, in theory, charities may suffer. If the donor only donates for the deduction, those taxpayers will not donate in the future. However, if the purpose is without care for the deduction, those contributions will continue.

4. TAXPAYERS WITH LARGE NUMBERS OF CHILDREN

As mentioned before, the $4100 personal exemption (for each family member) is abolished under the new law. For a couple with six children, they have a $32,800 deduction for personal exemptions under current law. That deduction is lost under the new law.

5. ELDERLY TAXPAYERS WHO SUPPORT CHILDREN, GRANDCHILDREN AND OTHERS

Similar to the previous thought, taxpayers who support children, grandchildren or other relatives have enjoyed the $4100 deduction for each of those persons they support (provide more than 50% of all living expenses for that person). This deduction also disappears.