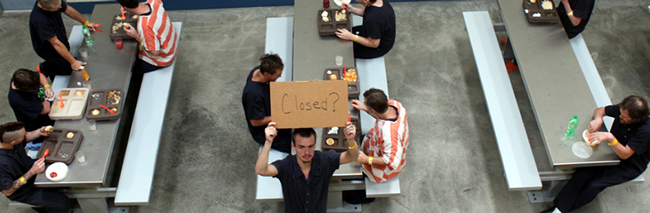

Jo Co Adult Jail Inmates © The US~Observer |

By Joseph Snook

Investigative Reporter

Undoubtedly, 2015 has already caught the curiosity of many citizens as local governments across the United States prepare to release their annual budgets. For Josephine County, Oregon the looming budget shortfalls are overwhelming.

Josephine County is largely a retirement community with nearly half of the population age 50 or greater. Grants Pass and its surrounding communities which make up Josephine County have some serious issues that aren’t likely to be resolved anytime soon. One major issue is the Sheriff’s Department. The question being asked by many is; “will the jail stay open?” And more often, “will there be a sheriff’s department at all?” Both good questions, but many people who I’ve talked to don’t have a legitimate understanding of the problems our sheriff’s department is facing.

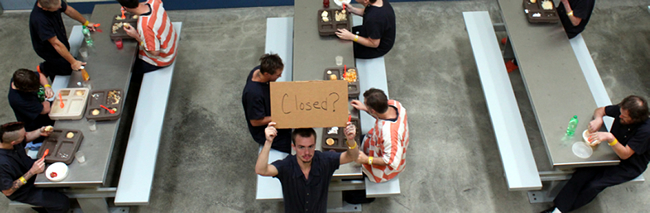

Sheriff Gil Gilbertson at Jo Co Adult Jail © The US~Observer |

After eight years of serving the community, Sheriff Gil Gilbertson will soon be replaced by Dave Daniel, the newly-elected Sheriff. Let me be the first to tell you, Dave Daniel has a mountain of inherited budget problems to deal with, and they weren’t created by Gil Gilbertson. Sheriff Daniel will inherit the common misconception by many that he is responsible for his department’s funding. All too often I hear people say, “I called the cops (sheriff’s), but they never came.” This statement is true, but the statement which usually follows, “we need a new Sheriff,” is simply incorrect.

The Sheriff, whether it be Dave Daniel, Gil Gilbertson, or anyone else for that matter, does not create the department’s budget. So, who does? The three elected county commissioners do. Even then, the county budget is heavily impacted at “higher levels” of government. Many people who follow this issue have referred to Senator Ron Wyden as, “a big road block for O&C funding,” giving county commissioners a more difficult task of producing and implementing no-nonsense funding options.

No response to a 911 call doesn’t equate to, “the Sheriff not doing his job.” There are only three deputies on average, patrolling at any given time; yes, only three deputies to serve and protect roughly “50,000 people.” Furthermore, the sheriff’s department is also responsible for, “(serving) civil papers, providing court security, …concealed weapons permits, and staffing the county jail among other things.”

During a recent conversation with Sheriff Gil Gilbertson, he was optimistic about his retirement, although I know he’ll miss law enforcement – it’s in his DNA. Just weeks before he retires, Gil could be found working on ways to implement cost saving strategies for the Sheriff’s Department. One being a similar plan that Dave Daniel will be working on; community involvement. Gil’s plan, “Operation Safe Keeping” lays out beneficial steps for the safety of Josephine County, without the presence of a fully operational Sheriff’s Department.

One problem that Gil shared is the projected budget for next year of 1.6 million. “No matter how you look at it,” he said, “we will have a closed jail if things stay the way they are.” Gil continued, “We must have a minimum of over 3 million dollars to keep our jail open.” Putting costs into perspective, The Sheriff’s Department’s budget, according to Gil, has dwindled from 12 million in 2011, to 5.7 million in 2012, followed by an estimated 1.6 million in 2015. All of this is related to the O&C federal payments that the county is no longer receiving in full.

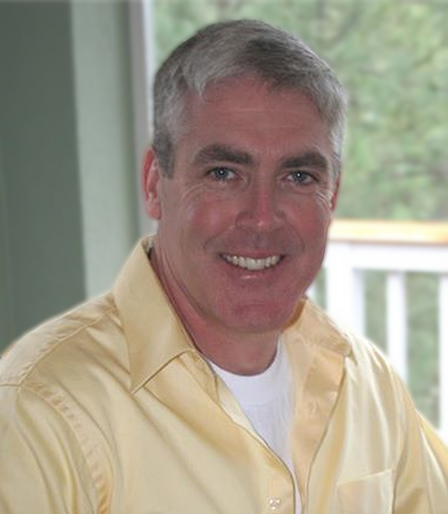

Sheriff Elect, Dave Daniel |

Dave Daniel, the newly elected sheriff, also weighed in on the funding crisis. His approach is to, “organize new and existing watch groups already working to help protect our community and bring them together.”Daniel continued, “Obrien, Williams, Sunny Valley, and others all have their own ideas and boundaries, but criminals have no boundaries.” He believes further organization with surrounding communities, getting them all, “on the same page,” will help alleviate the crisis. Without a fully operational department, Sheriff Daniel will need help from the community – help that could look like this.

According to Gilbertson, tax levies (higher taxes on county property owners) are an unlikely option to help fund the Department. In fact, voters have consistently voted “no” on every single levy proposal since 2000, according to Gil. Some residents say, “it’s only a couple dollars, why not? We can afford that.” Other’s have stated, “a couple dollars here, a couple there, it all adds up to hundreds, if not thousands a year, and we simply can’t afford it.” Good policies make great communities, but when a problem like the Sheriff’s budget is placed solely on the property-owning taxpayer we apparently have a larger problem.

Why can’t we afford a levy?

The demographics of Josephine County leave little to be desired economically and the statistics support the problem. Nearly 30% of Josephine County residents receive some kind of welfare, with over 30% of its residents on food stamps. Over 20% of Josephine County residents live at, or below the poverty level. Josephine County also has the third highest percentage of people living in poverty in the entire state, just behind Malhuer and Klamath County, according to OregonLive.com.

Additionally, our unemployment rate is in the double-digits. Roughly 50% of our residents are at or near retirement (fixed incomes). A well-known home builder stated, “we need a strong economy before a tax hike will resonate with our county.” Considering the statistics, they’re representative of why the voters have turned down increased tax levies to fund law enforcement over the last 14 years.

Potential Solutions?

Simon Hare, the youngest county commissioner in the state who is about to start his second term, weighed in on the crisis we face. He believes that, “congress hasn’t committed to funding in a timely manner.” The federal government has previously provided logging counties with funding in exchange for “not harvesting timber,” better known as the O&C Timber Funds. Simon continued, “there are trees on the carpet in the capitol building for a reason, it’s what Oregon does.”

Oregon State Capitol Oregon State Capitol |

Speaking of projects that could help, Simon continued, “managing our county forests better could result in roughly $400,000 – 500,000.00 additional funds annually.” Managing our resources more efficiently is something Simon is, “always working on.” With 12 million dollars required to effectively fund our county law enforcement, Simon has been, “focused on small projects that are much easier to complete. This will help allocate funding, which will ‘chip away’ at the overall budget deficit.”

Another solution described as, “totally likely” by Simon is some sort of a state mandated tax increase or fee increase on Josephine County residents. If the funding simply isn’t there, the commissioners could declare, “a criminal justice state of emergency,” which would give the state power to implement increased taxes, without a vote of Jo Co residents, “matching .50 cents on the dollar for tax revenue.” Simon touched on increased taxes, claiming, “That would likely make the people mad, and we’d (commissioners) all be recalled,” if the commissioners signed a law enforcement state of emergency declaration.

Jo Co Commissioner Simon Hare |

Commissioner Hare continued, ” I have asked several non-binding questions in an effort to help leaders advocate for more timber harvests. 89% said they wanted timber to be harvested, and the forest replanted after wild fires. 70+% said that forest management was an appropriate revenue stream to pay for vital county services. The only real solution is higher taxes or shared receipts from timber harvests on O&C (50%) lands or Forest Service (25%).”

This past July, Sheriff Daniel started working with citizens and local businesses, privately retaining a poll conducted by Strategic Research Institute. The poll was conducted for the purpose of securing a tax levy. The poll found, according to Daniel, that, “the Citizens of Josephine County will pass a levy if they’re promised three things; rural patrols, safe children and jobs.” The levy costs would be $1.49 per $1,000.00 in assessed property value. Although Daniel is not directly responsible for the sheriff’s budget, he was working on a solution well before he was elected.

Taking a more direct approach to the issue, Tim Cummins, an expert in timber acquisition, stated, “the O&C lands were for management only, not ownership. We need to get out of the O&C County Association, file a lawsuit against the BLM (Bureau of Land Management) for breach of contract, and take back our lands.” This begs the question: Why are we not collecting a payment, in lieu of tax from the Federal Government for keeping our lands? This raised more debatable questions. Some say, “there is no history of legislation where our lands could be reverted back to county ownership or management.” Others say, “the U.S. Constitution (Article 1: section 8, clause 17) never gave our federal government the power to own more than 10 miles square in any state, without consent of the state legislature – which is evident in most Eastern States.”

Sustainable timber harvests are not the only natural resource solution; mining also has a (potentially) strong presence in Josephine County.Mining could generate more jobs, giving more people an income, creating additional income tax revenue. Alternative environmental solutions such as industrial hemp also present viable options that could potentially work, considering the strong opposition by environmentalists to harvesting timber, and mining. People have been talking about harvesting hemp on our county lands for years, which is now legal. Hemp, not to be mistaken for marijuana, has a profitable yield, especially taking into account the 50,000 uses it provides. It can also potentially be harvested up to three times annually.

Conducting further research, I ran across The American Lands Council (ALC). It appears that, “federal lands” are being, or attempting to be“taken back (from feds) by the people and/or individual states.” According to ALC’s website, “The Mission of the American Lands Council is to secure local control of western public lands by transferring federal public lands to local stewardship.” Earlier this year, Peter Defazio (D) stated, “Josephine County is 70 percent (1,149.4 square miles) owned by the federal government (including county and state lands) and is surrounded by federal forest lands in need of management.”

The solution given by ALC appears to be exactly what many people have been asking for, especially considering what Defazio stated. Some people believe that taking back our lands (from the federal gov’t.) won’t work, or, has as good of a chance as “forming the State of Jefferson.”Perhaps this is the mindset that has kept us so dependent upon federal funds, which is now bankrupting our local governments, and attributing to our double-digit unemployment rates

Josephine County must eventually take necessary measures to utilize our natural resources in a sustainable manner, providing for ourselves and our community. This is nothing new. If we fail to get resolution, we will likely see more welfare dependents along with a continuously failed budget for law enforcement. The majority of voters in Jo Co have indicated several times – they do not want “more taxes.” The general consensus among Jo Co residents is, “funding government by placing more taxes on us, (property owners) will not happen. Our elected officials shouldn’t put their budget before the will of the people who elect them. The budget shortfall is solely due to the O&C Timber Funds. If the federal government won’t fund our county (revenue from federally controlled land), then we must not penalize the people for their (government) in-actions.”

In the near future, something will happen, and this writer believes the residents will be looking at higher taxes mandated by the state.

If it’s not too late already, Josephine County residents should be proactive in pursuing alternative funding in order to keep a “mandated tax hike at bay.” If the public doesn’t want higher taxes, it will take all of us, working to implement revenue generating solutions – our own editor, Ron Lee, has one such proposal; a nationwide raffle of local goods and services which he says could generate over $500k a year for the sheriff’s department.

One thing is for sure, until we either find ways to generate revenue, or the state mandates a tax hike, law enforcement will be almost non-existent in the county and our jail… who knows?