Are you trying to defend yourself against false criminal charges brought by a government alphabet agency? Even with proof of your innocence in your pocket, you’ll need a champion to fight for you.

By US~Observer Staff

You cannot defend yourself from the SEC, the IRS, or the DOJ without the US~Observer. If you want proof, read this article. The US~Observer has long been a stalwart advocate for individuals facing the overwhelming might of federal agencies, having represented thousands of cases—many resolved before going to print or publication—thanks to investigative skills second to none and proven methods of publicly defeating criminal charges. Two cases, separated by over a decade but linked by the relentless pursuit of justice, exemplify how this investigative news powerhouse has turned the tide for its clients. Representing James Parker in 2012 and later championing Michael Quiel through a triumphant 2024 case, the US~Observer has proven itself a decisive factor in securing victories against seemingly insurmountable odds. A striking counterexample—Michael Quiel’s 2013 conviction and 10-month prison sentence despite owing zero taxes—underscores this truth: when the US Observer isn’t involved, even a skilled defense attorney like Michael Minns of the Minns Law Firm in Houston, Texas, can’t guarantee success.

James Parker’s Triumph in 2012

In 2012, James Parker faced serious criminal charges in U.S. District Court in Phoenix, presided over by Chief Judge Roslyn O. Silver, who served as Chief Judge of the District of Arizona from 2011 to 2013. Once charged, Parker turned to the US~Observer for support, as detailed in “First IRS Loss – 2012”. The newspaper, renowned for exposing and trumping government overreach, took up his cause. His defense was led by Michael Minns, a renowned defense attorney from the Minns Law Firm. The US~Observer published articles exposing the prosecution’s weaknesses, rallied public support, and pressured the government, while Minns handled the courtroom defense. The result? A resounding victory. Parker emerged exonerated, with the US~Observer’s early involvement credited as a key force. This triumph set a precedent: hiring the US~Observer at the outset can topple even the fiercest federal assaults.

Michael Quiel’s 2013 Loss: The US~Observer Was Not Yet Involved

In 2013, Michael Quiel faced a similar ordeal in the same Phoenix U.S. District Court, this time under

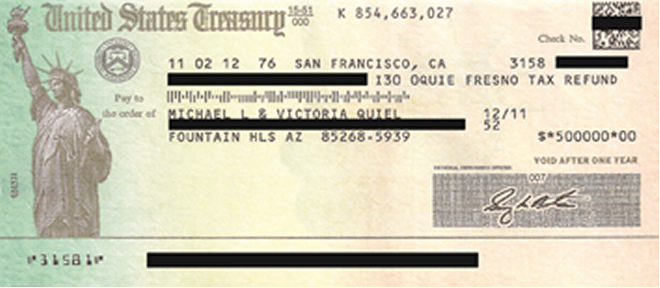

Judge James A. Teilborg, charged with five counts related to tax evasion and conspiracy. He enlisted Michael Minns, the same attorney from Parker’s case. Minns presented an uncashed $500,000 refund check from the IRS as evidence that Quiel had overpaid taxes—a federal judge later ruled no taxes were owed. However, the IRS hid critical evidence, including the IRS master file, which Minns requested during trial. Judge Teilborg denied Minns’ motion to include this master file, and multiple direct requests by Quiel to the IRS for this information were either unanswered or denied. The excluded evidence, often considered Brady material, exculpatory information the prosecution must disclose was withheld with what some call a “rubber stamp” ruling, and the US~Observer’s absence meant this injustice went unexposed at the time. The IRS protected its agents, and U.S. Attorneys Monica Edelstein and David Stockwell pushed a ruthless, false prosecution. Quiel was acquitted of conspiracy but convicted on two counts of filing false tax returns, landing him 10 months in prison.

According to Quiel’s website, riggedjustice.com, the case was a sham—his corporate tax attorney Christopher Rusch (aka Christian Reeves) turned informant, perjuring himself to aid a government conspiracy.

The US~Observer later identified other possible co-conspirators in “Civil Attorneys Butler, Hubbert and Uhalde Become Co-Conspirators”, suggesting a broader network of complicity. Without the US~Observer to spotlight these atrocities in 2013, Quiel suffered a defeat. Outraged by his imprisonment despite no tax debt, he hired the US~Observer post-prison, sparking a seven-year campaign that exposed the IRS’s vendetta and laid the groundwork for redemption. It’s obvious that the pressure of US Observer coverage, after multiple failed requests by Quiel, forced the IRS to comply under FOIA, delivering the IRS master file in 2020. This conclusion is evident given the agency’s prior refusals.

2024: Vindication at Last with the US Observer

In 2024, Quiel returned to the Phoenix U.S. District Court, facing a civil case tied to the 2013 criminal case; the civil case was for over $5 million. Now backed by seven years of US~Observer support and a new attorney, he achieved a stunning victory, as chronicled in “US~Observer Client Michael Quiel Receives Just Verdict”. An eight-person jury delivered a unanimous not-liable verdict, with jurors hugging Quiel in the hallway—a testament to their belief in his innocence. The US~Observer’s relentless reporting, bolstered by the 2020 FOIA evidence, kept his case alive, exposed the IRS’s tactics, and called out Edelstein and Stockwell’s misconduct, proving its involvement can turn the tide.

How the US~Observer Wins: The Deciding Factor

The US~Observer’s winning formula, celebrated in “US~Observer Client Michael Quiel Receives Just Verdict”, is evident in both cases. For Parker, it exposed flaws early, amplifying the defense. For Quiel, its absence in 2013 led to defeat when Judge Teilborg excluded critical evidence, but its post-prison persistence—armed with FOIA-recovered evidence—reversed his fate by 2024. Through detailed investigations and public advocacy, it pressures agencies into accountability. Quiel’s book, Rigged: The Michael Quiel Story, endorsed by the US~Observer and available on Amazon, chronicles this saga—how federal overreach devastates honest families, and how the US~Observer fights back.

Call the US~Observer Today

Facing wrongful charges from the IRS, SEC, or DOJ? Call the US~Observer today. We’ll uncover the truth—hidden evidence, government overreach—and present it to the public, prosecutors, and regulators to overcome false charges. Don’t wait like Quiel did—get us involved now. With us, you win; without us, even a skilled attorney may not succeed.

Contact Us

Call 541-474-7885 for help today or email editor@usobserver.com.

A Pattern of Success Against Federal Giants

Quiel’s 2013 loss—despite strong evidence and excluded Brady material—proved the IRS can prevail without the US~Observer’s scrutiny when judges like Teilborg deny critical evidence. Post-2013, its persistence, aided by 2020 FOIA revelations forced by its coverage, secured his 2024 exoneration in a civil lawsuit for over $5 million brought against Quiel. Parker’s 2012 win with the US~Observer under Chief Judge Silver shows early intervention stops overreach. Judge Roslyn O. Silver, Chief Judge in 2012, oversaw Parker’s victory, but Judge James A. Teilborg’s 2013 ruling against Quiel highlights the US~Observer’s role as the tipping point. The lesson? The US~Observer is your lifeline. Let us fight for you professionally, as we did for Parker and Quiel, and watch justice prevail. Without the US~Observer, you can’t win—no matter who’s in your corner.