Have you or someone you know done business with Christian Reeves

(also known as Chris Reeves; aka Christopher Rusch; aka Chris Rusch)?

Have you been indicted after dealing with him? Have you been cheated

out of your finances as a result of investing with him, or at his direction?

Call the US~Observer at 541-474-7885 if you have any information about

Mr. Christopher Rusch / Christian Reeves.

By Edward Snook

Investigative Reporter

Arizona, California, Offshore – Based on rulings in 2013 from the United States District Court for the District of Arizona and subsequent rulings from the Ninth Circuit Court of Appeals, a person’s attorney can blame that person for crimes the attorney actually committed. That attorney can then testify in open court against his client(s), just as Christopher Rusch did in 2013 against Michael Quiel and Steve Kerr. In the case of Rusch’s clients, they were sentenced to prison for 10 months each. Rusch had cut a deal, and that has serious implications for anyone dealing with him now.

For Michael Quiel, he was found guilty on two counts of filing false individual income tax returns even though the trial court found that he had ZERO tax liability and had not engaged in any conspiracy to defraud the government! It was an outrageous verdict that is continuing to be challenged to this day by Michael Quiel. Unfortunately, the fact that Quiel had ZERO tax liability was established at sentencing after Quiel had been found guilty by his totally uninformed jury. All the jury heard during trial was that he owed millions in taxes. It was a lie but one that helped convict him – had the US~Observer been involved no one could have been deceived, that’s why our services are so valuable!

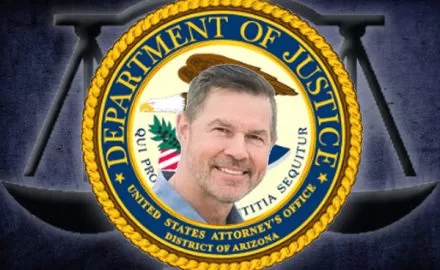

In October of 2013, we published an article titled “Attorney Rusch turns on clients, Gov’t fails to prove tax due.” After publishing, we learned that Mr. Rusch changed his name to Christian Reeves in order to get rid of his ruined, given name, and to potentially give himself cover to ensnare more unsuspecting, otherwise law-abiding, citizens in financial schemes that take their money and land them in prison.

The US~Observer was contacted to take on Michael Quiel’s case years after his conviction because of that article. We have since started a covert investigation into the activities of Christopher Rusch / Christian Reeves, using a full team of US~Observer investigative journalists, that continues to this day.

The US~Observer Investigation of Christopher Rusch / Christian Reeves

While conducting our initial investigation of Reeves, we found that he would be speaking at a conference in December of 2018 in Dallas, Texas. We were able to obtain a brochure of the conference that showed the scheduled speakers along with their pictures. Shockingly, Christian Reeves, was the only speaker listed without a picture.

To verify that Christian Reeves was in fact Christopher Rusch, and to retrieve as much information as possible, the US~Observer sent one of our team members to Dallas to attend the conference. Once there, our investigator verified that Reeves was indeed Rusch, and quickly obtained other valuable information.

(We have since learned that Reeves was the person who was contracted to produce the brochure by the group putting on the December conference. This means Reeves purposely left his picture off the brochure as to not be exposed as Rusch.)

Going Covert

Next, this writer created the alias Ernie Stone along with a fabricated resume, phone number, etc. I contacted Reeves at his San Diego, CA office, telling him I was an investor with roughly $30 million to invest. Reeves initially attempted to pass me off to one of his “partners,” David Drummond, who called and informed me that Reeves had given him my contact info. After the call I immediately sent Reeves an email informing him that I would only deal with him and no others – he agreed. (Click here to view the email chain in its entirety, wherein Reeves described some of the things he would do for Ernie Stone.)

After lengthy discussions, I told Reeves I wanted to hire him to help me invest my money offshore in Belize, Puerto Rico, Panama and/or Mexico, all places that Reeves recommended during our communications – these are some of the identical countries that Rusch promoted to Quiel and Kerr when he was in the process of scamming them. Throughout our conversations Reeves readily gave me legal advice, something he (Rusch) had been disbarred by the California State Bar Association from ever doing again, when convicted of financial crimes of dishonesty.

As our consultations moved forward, Reeves provided me with a proposed contract for his services. Upon agreeing to pay Reeves $30,000.00 for his services, I asked him if he wanted a check or cash. Without hesitation, Reeves stated he would rather have cash. We then agreed to meet in Portland, Oregon on February 8, 2019.

A team member and I arrived in Portland, settled in and waited for Reeves. He arrived on schedule, and we started a lengthy conversation over a cocktail. Upon obtaining the information we were after, I handed Reeves my business card, and informed him my name was actually Edward Snook with the US~Observer. I then hit him with the fact that I knew his former name was Christopher Rusch. My associate snapped a picture as Reeves sat there stunned, starring at my card. We then asked more questions of this disbarred attorney – not surprisingly, most of his responses were lies.

Before parting ways, I pulled a check out of my pocket and informed Rusch / Reeves that I wanted to pay for his travel expenses as I had agreed, and he refused to accept the check.

The following morning afforded us another meeting with Rusch / Reeves. He was initially closed-off and unwilling to engage but we convinced him that we believed his lies from the night before. We had successfully set another hook into Christian Reeves.

With our time over and Reeves on his way back to San Diego, my associate and I traveled back to our main office where we soon perfected our plans with other team members who had already begun infiltrating Mr. Reeves’ deceptive world.

Currently we have spoken to nearly every associate of Christian Reeves, both past and present. Some of these people knew who we were, and others did not. Every one of those we have questioned, except for David Drummond, have denied having any current dealings with Reeves and most claim they will have nothing to do with him and his abundance of dirty laundry. However, we currently have team members entrenched within Reeves’ world, continuing to report on the business dealings of several of Reeves’ associates and Christian Reeves himself.

Rusch / Reeves – Confidential Informant for the IRS?

We have obtained plenty of evidence that would lead any prudent person to believe that Christian Reeves, formerly Christopher Rusch worked with the IRS and the United States Attorney’s Office (USAO) as an informant and most assuredly still does. We can’t publicize much of what we have uncovered yet, since our investigation is ongoing. However, it was his deal-taking and testifying in Michael Quiel’s case that proves Rusch was working with the IRS and the USAO in the first place.

From 2006 to early 2010 Christopher Rusch was advising Quiel on taxes and investments. Rusch convinced Quiel and his partner Steve Kerr that certain oversea investments were legitimate and was able to convince the two to invest in the Rusch ventures. Rusch set some of the ventures up in Switzerland, the largest international banking community outside the US. Because Rusch was a licensed attorney at the time with the California Bar, Rusch was allowed to infiltrate two of the most prominent banks in Europe, Union Bank of Switzerland (UBS) and Pictet Bank. The banks that Rusch was working with gave his information to the US Government and the Federal government subsequently arrested Chris Rusch in Panama.

The government then flew Rusch to Miami from Panama for only one reason, to start their diesel therapy. Diesel therapy is simply horrible abuse meant to prepare an individual to comply with whatever the authorities want. For Rusch, diesel therapy was riding in buses from prison to prison as he experienced severe emotional and physical pain and suffering, until he was relocated to a federal maximum-security prison. Rusch was held in prison for 5 months until he finally caved in.

According to Rusch, “When your physical safety is at risk on a daily basis, and you are facing 5 years versus 10 months, it’s hard to fight the system.” Rusch continued, “the experience I went through with the IRS and Department of Justice was unbearable. In prison I was forced to live with terrible drug dealers and other dangerous criminals.”

Having finally broken down, Rusch took a deal and worked with the IRS and the US Attorney’s Office in Phoenix, Arizona to successfully prosecute Quiel and Kerr in federal court on tax crimes. Even though Rusch’s false testimony against his own clients was obviously obtained under duress, Rusch sold his own soul down the river the day he turned on his own clients.

Quiel was convicted on the two lesser counts of filing false individual income tax returns. He was acquitted on both the Conspiracy to Defraud the United States charge and two counts of Failure to File Reports of Foreign Bank and Financial Accounts. Quiel, Kerr and Rusch all served the exact same sentences – ten months in prison.

Let’s figure this out logically, Chris Rusch agreed with prosecutors and the IRS to testify in court that Michael Quiel and Steve Kerr conspired with him to Defraud the US Government; however, the jury acquitted Quiel and Kerr of Conspiracy. The only conspiracy was between Rusch, UBS Bank, Pictet Bank, the US Attorney’s Office and the IRS. This is proven by the testimony of a bank officer in open court that Quiel never received any funds from the bank, and even though he was listed as the sole beneficiary on the accounts, he could not access any funds held in the accounts – only Rusch and Rusch’s chosen Intermediary were allowed to obtain funds. So, if Quiel wasn’t part of Rusch’s conspiracy as the jury determined, the only thing the jury used to convict him of anything was the government’s assertion that Quiel owed taxes. The reality was he didn’t owe anything – a fact that the jury should have been able to hear. Quiel was falsely convicted on a lie. It is a travesty of justice that he had to spend any time in prison at all, let alone the same amount of time as the man who orchestrated and committed the scheme from the beginning!

When Rusch was released from prison he was immediately allowed to travel internationally and continue working in virtually the same financial businesses he was in when he got busted. View the following court order signed by United States Senior District Judge James A. Teilborg on Dec. 30, 2014.

US~Observer Conclusion

I have been investigating these types of cases for over thirty years and the Rusch / Reeves case is the first time I have ever witnessed when a person convicted of a federal, felony crime of dishonesty involving securities, was immediately allowed to continue working in the field of securities and travel abroad, upon their release from prison.

Was the US Attorney’s Office in Phoenix involved in the decision to allow Rusch / Reeves to continue the very activities that created this criminal case in the first place? At the very least, they had to have known of Rusch’s activities after he entered into their plea agreement and before he was finished serving his post-prison supervision. The truth is however, that Rusch’s agreement to falsely implicate his clients was an agreement that originated with the Internal Revenue Service and/or the Department of Justice!

Apart from the damage Rusch caused to Michael Quiel by lying about his involvement in Rusch’s illegal ventures, Quiel’s family was greatly harmed. According to Quiel, “At one point I thought my family had been ruined by the false prosecution they endured right alongside of me. That’s one thing that gets overlooked; the immense collateral damage caused to family members when an innocent person is falsely charged, and the outright suffering and loss they go through if their loved one is actually convicted. Thankfully, we have endured. I just hope it doesn’t happen to anyone else.” To that end, Michael Quiel has set up a GoFundMe page, in part, to help continue his fight to clear his name while also aiding others who face being prosecuted on false charges.

One thing is certain, with the US~Observer shadowing Christian Reeves – or whatever his name may be in the future – we will make sure to be there for anyone else who he may deceive, fleece, abuse and feed to government prosecutors.

Editor’s Note: Call the US~Observer at 541-474-7885 or send an email to editor@usobserver.com if you have any information regarding Christopher Rusch, also known as Christian Reeves or any of his associates.

Don’t miss the next edition of the US~Observer wherein we will expose exactly how Mr. Rusch literally stole Michael Quiel’s identity. We will report how Rusch set Quiel and Kerr up to take the fall if he had any problems with his dealings with UBS and Pictet Banks in Switzerland. We will factually show just how Michael Quiel’s jury was deceived by the prosecutors in this bizarre case!