Michael Minns Defeats Gov’t in Criminal Tax Case

Former lawyer Melissa Sugar is in no way “sweet” as her name suggests. With her master’s degree in tax, and a lot of honey-pot tax ideas, she represented many clients who were later indicted for following her advice. Sadly, once they were indicted, Ms. Sugar became a potential witness against them. All but one of her indicted clients now have serious and permanent criminal records. The one who didn’t hired the author of the Underground Lawyer and the most winning lawyer against the IRS there is; Michael Minns of Minns and Arnett out of Houston, Texas.

An Impossible Criminal Tax Case?

What makes a case impossible to win? Well, for Dr. Jerold Sorensen of Fresno, California, almost everything.

To begin with, he was up against IRS special agent, Michelle Hagemann, who had only lost one case in her entire career. That was the case of Jim and Pamela Moran of Seattle, Washington. (The US~Observer was involved in that case along with renowned Lawyer Michael Minns.) Also working against him, Dr. Sorensen had been part of an organization where he attended financial seminars advised by seminar students and lecturers who then testified against him. Ms. Sugar was also one of the teachers at the seminars he attended.

At the insistence of his lawyers and advisors, Dr. Sorensen sent letters – which he did not write but had signed – to the Grand Jury, a Federal Judge, the Assistant Prosecutor handling the investigation against him, Assistant United States Attorney (AUSA) Matthew Kirsch, and others. The government interpreted the letter as a threatening instrument used to attempt to obstruct the investigation. This would lead to the most serious charge against him, under 18 USC 1503, Obstruction of Justice – a crime that carries a potential prison sentence of ten years.

Sorensen hadn’t questioned his advisors when they handed him what many jurors might well consider threatening letters to the officials investigating him. He also sent letters to Ms. Sugar and numerous other clients of both Ms. Sugar’s and the organization she worked in tandem with, Financial Fortress Associates.

Dr. Sorensen had also been advised by Michael D. Beiter, Jr. At the time of Sorensen’s indictment, Beiter was serving a 300-month sentence at the Federal Correctional Institution Estill for filing false claims for tax refunds and conspiracy to defraud the IRS. The statute for this crime carries Ten Years in the Federal Pen. Bieter was the original architect of the tax plan Sorensen was advised to use. No one thought Dr. Sorensen should know this before selling him the plan.

The Government’s Corrupt Endeavor

In addition to the charge of Obstruction of Justice, Dr. Sorensen was charged with the smaller offense of, 26 USC 7212 (a), corrupt endeavor to impede the IRS. The government claimed he failed to pay $1.5 million in taxes due from the years 2002 to 2007. Both indictments were issued in September of 2013. Corrupt Endeavor was the Government’s newest pet project charging instrument – it’s a charge that could be morphed into many things. Making it part of a tax case had the effect of eliminating the necessity of proving willful intent to violate the law.

Even though Dr. Sorensen was one of those out-of-the-box medical thinkers who was very successful, he also trusted just about everyone. In fact, he was “Mr. Gullible.” Many people have heard of offers from a Nigerian Prince who would make them wealthy if only you can give him a loan. But, how many have been conned into making the loan? Very few statistically. However, Dr. Sorensen was one of the rare ones who flew overseas to meet the Prince. He was lucky to escape.

In the beginning of his criminal tax troubles, Sorensen ended up with a distinguished law firm out of California, Hochman, Salkin, Toscher & Perez. Dennis Perez represented him. Perez is one of the most respected tax lawyers in the country. Perez even lectures about civil and criminal tax defense all over the country.

After reviewing the case, Perez wisely discussed pleading guilty with him. Perez also wisely convinced him to answer questions that Sorensen had been ordered to answer by a Federal Judge but had at that point not yet answered. Sorensen had been held in contempt for that. And that contempt was part of the indictment against Sorensen for Obstruction. Sorensen, through his lawyer, Perez, did the one and only thing that a trial lawyer would later be able to use to defend him, he ultimately obeyed the court order and served AUSA Kirsch with all of the documents he had previously been held in contempt of court for not providing.

Then Perez did something that most criminal defense trial lawyers will advise clients to be more careful about. He set him up for what is commonly called a “Queen for a Day” meeting.

Queen for a Day, Guilty Forever?

The “Queen”, the person who is being investigated, meets with the prosecutors, and if he can make them happy, they cut a deal. The typical agreement, however, is that the Queen gets nothing except the promise of consideration of a deal, if the government likes what he has to say. Often, they go back and forth until the government really likes what they say, and then they either make a deal or don’t make a deal. The government is usually by agreement, not allowed to use any of the statements unless no deal is made and the case goes to trial, and the Queen gets on the witness stand.

These meetings are almost never recorded. Recording wouldn’t usually help the Government much. They go like, “Did you know you were cheating on your tax returns?” …. “Not really”. … “Counsel you need to take your client out of the room and talk with him, this isn’t going to result in a deal being made.” Eventually counsel, knowing the game, gets his client to be more compliant and say things that will hurt him if he takes the stand. And a deal is almost always made.

But if there is no deal, defenses are often given up. The free-look into how a person testifies makes him/her a much easier target if they were to go to trial. That person has waived so many rights they become very difficult to defend. In tax cases it almost always includes jail time unless the deal is made with a snitch, who may be a friend, the client’s own CPA – who in this case was Rita Sharp and who testified eagerly against Dr. Sorensen – or the client’s own lawyer – in this case Melissa Sugar. If the person were to take the stand during their trial, without a deal, and if the government disagrees with what they said, then witnesses in the room during the “Queen for a Day” meeting, usually the special agent, get on the stand after the person’s testimony, and explain their version.

Reporters and Trial Lawyers will tell you that this witness, a professionally-trained government employee, is generally more institutionally believable than the accused person, because they have status and witness training. Therefore the government’s version is rarely disbelieved by the jurors.

Even an innocent person can easily say incriminating things. In Dr. Sorensen’s case he truthfully admitted that he had seen some red flags and probably should have done more research. On nearly everything else, Sorensen and the Special agent, would, at trial, disagree on.

The only time there is an upside of throwing yourself on the mercy of the prosecutor is when you have no chance of winning your case and no intention, no matter what happens, of actually going to trial. If your lawyer has a working relationship with the prosecutor and trusts him completely, then a fair deal might be worked out.

The downside is obvious. With very few exceptions, never accept a “Queen for a Day” invitation if you are innocent or if there is any chance of a trial. A difficult trial to defend then becomes impossible to defend unless the lawyer can avoid putting the client on the stand, or has an incredibly effective cross for the agent who will take the stand and tell the jury their version of what the client said “confidentially” in the “Queen for a Day” meeting.

This reporter has been unable to find a criminal tax trial where Dennis Perez was lead counsel and a jury returned with a verdict of “Not Guilty” on all counts. In fact, I reached out to Mr. Perez via email and asked, “how many criminal tax cases have you successfully defended through trial to acquittal?” There has yet to be a response.

While Perez was probably sufficient for tax computations or an agreed plea, and did a great job by having Sorensen submit the documents, he really did Dr. Sorensen a disservice by recommending the meeting. Once the “Queen for the Day” performance was finished, if Sorensen originally had a 50/50 chance of not guilty on both counts, it was probably reduced from 50% to 1%.

Enter the Hagemann Slayers

When Sorensen was asked to sign the confession typed-up for him – negotiated by his counsel, Perez – the government included swearing to facts that he believed were not true. So, the doctor refused the deal and told his counsel he wanted to go to trial. Ultimately, Sorensen found and hired the law firm that had beaten special agent Hagemann in the Moran trial in 2007, Minns & Arnett – in the Moran case though, there had been no “Queen for a Day” meeting to contend with.

The first thing that Minns filed on behalf of Sorensen was a witness list that included the name of the assistant US attorney who was trying the case. Minns told AUSA Matthew Kirsch that he had an obligation to withdraw as a conflict as a material witness because the government wanted to prove that he had received a nasty letter from Sorensen, and the defense wanted to prove that Sorensen had ultimately obeyed the court order and had delivered the materials to Kirsch, the AUSA.

This caused a series of hearings and arguments. The court and the Government suggested that the best way to handle it was to simply stipulate that those facts were true and let the trial proceed.

Minns disagreed saying that he felt the most effective way to try the case was to put Kirsch on the witness stand and have him truthfully testify that he didn’t feel threatened by Sorensen. Minns also wanted to show that, contrary to the representations in the indictment, Sorensen had ultimately obeyed the court order as he had hand-delivered the materials to the witness, Kirsch, right after he retained competent counsel in Perez.

It is never a good idea, if you have a choice, to personally rile-up the Judge.

The choice here was to let in facts by stipulation, but not through witnesses. Minns explained that this was his trial choice and he would not take the AUSA off the witness list. The court explained he could order it stricken and Minns should voluntarily take Kirsch off. Minns refused. The court had denied the motion to recuse the AUSA as a witness three times. Finally realizing Minns would not back down he re-examined the position and decided to give the AUSA the chance to either get another lawyer on the case and get an extra 30 days to find one and get prepared, or dismiss the count.

The AUSA offered a compromise: Go to trial on one count only, the one where Kirsch was not a witness, sever the other one out, and let Sorensen have two trials. Minns objected to that. He would not waive the speedy trial act which this scheme could have impacted. The court then re-set the trial date for the following week and gave the government until that Friday – just a few days – to make a decision.

So, the government’s choice was between going forward with a new lawyer, which would move the case forward (which might also violate the speedy trial act), or dismiss the ten-year count.

On that Friday, the government made the decision to dismiss the count of Obstruction with prejudice and go forward with the Corrupt Endeavor charge. Dr. Sorensen had been facing fifteen years and two counts. He was now facing five years and one count which was almost the same as the plea bargain he was offered and had turned down.

When a professional, Doctor, Lawyer, Realtor, has a felony conviction, it also has serious professional ramifications on top of prison and fines.

In an income tax case, the amount of the alleged income is calculated into the sentence guidelines and usually decides how much time the accused must serve. That can also be the case in Obstruction. On Corrupt Endeavor it is not the deciding factor.

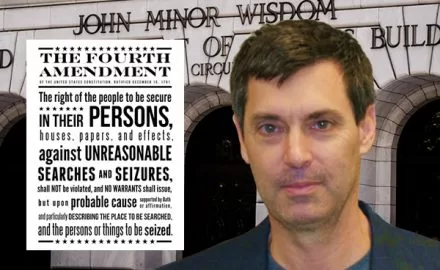

When the Sorensen trial went forward and the government had completed its case, it was Sorensen’s turn and Minns objected because the corrupt endeavor count was being used instead of income tax evasion. All income tax evasion cases require willful evasion, which means the accused must understand the law and make a conscious decision to violate it. That is not the case in Corrupt Endeavor. Even though he was right, Minns was overruled.

Dr. Sorensen then took the stand and admitted there were “red flags” he should have taken more seriously. He, however, had put his faith in his advisors, believing they knew the law; that he, himself, had always tried to follow the law and be a good citizen.

Because Sorensen testified, the court allowed the government a rebuttal witness. IRS special agent Hagemann, who had been present at the “Queen for a Day” meeting, virtually called Dr. Sorensen a crook and a liar and that he had all but confessed during the meeting. Hagemann’s reported mischaracterizations were damning, and the judge disallowed the defense from calling their own rebuttal witness. This witness, a local lawyer who is highly respected and has great credibility, would have testified that Hagemann’s representation of the meeting was not at all accurate.

Guilty?

At that time in the US there had not been a “not guilty” in the decade before on a tax-related Corrupt Endeavor count. This case was no exception, and without doubt, because of Hagemann’s “twisted” recollection, Dr. Sorensen was convicted.

Although only one year of prison was recommended after lawyer Ashley Arnett masterfully handled the pre-sentencing, the Judge deviated from that suggestion and ordered 18 months. It was a far cry from the potential of 5 years, but no picnic, either. Unless the conviction was thrown out, Dr. Sorensen would be branded a felon for life.

As this case was going up the ladder of appeals, another case Marinello v. United States was also going up to the Supreme Court. Marinello, was argued by Matthew S. Hellman, a master appellate lawyer of the firm Jenner & Block. In 2018, using virtually the same argument Minns had made for Sorensen in the 2014 Denver Trial, the corrupt endeavor for most tax crimes was tossed out, Marinello was reversed.

“Not Guilty”

A month later Sorensen’s Coram Nobis appeal was filed on that same theory. The court held it for nearly ten months before tossing out the remaining conviction against Sorensen.

With that ruling, Dr. Sorensen got his life back.

A review of the court’s order vacating the conviction makes it clear that the court did not believe Sorensen was actually innocent. It appears the judge believed the law required him to vacate the conviction on a serious legal technicality of charging Sorensen with the wrong crime. Since history can’t be redone, and since the doctor no longer has a criminal record, no one will ever know if the unfavorable slant was in part caused by the materials obtained in the “Queen for a Day” meeting.

This reporter does not believe in the practice of “Queen for Day” rituals for innocent clients or clients who have a defensible case. And of course, any client hiring Minns & Arnett, has a defensible case by statistical definition.

The corrupt endeavor act, used for income tax cases, was itself a little “corrupt” allowing government to try tax cases without the nearly century-old protection of willfulness instruction. The lawyers for Marinello and Sorensen are all to be congratulated for their efforts to eradicate this inappropriate government prosecution tool. It is very possible, without the “Queen for the Day” to deal with, Sorensen might have won the verdict outright.

The Scorecard

The first battle ended with the Sorensen’s defense beating the obstruction count – One.

The next was a win for the government who secured a greatly diminished felony conviction and only 18 months out of a possible five year sentence – One.

However, the war ended in 2019 with the government’s conviction overturned and there being no felony record. Sorensen’s defense TWO. Government ZERO.

That is how impossible cases are won – you keep fighting and you have those on your side that just don’t give up.

As for Ms. Sugar? It has been reported that she went to prison. Justice, how sweet it is…

Congratulations Michael Minns. It was another masterful case.

Editor’s Note: Dr. Sorensen declined to comment on this article.