Michael Quiel Continues Fight for Innocence

Now Alone, Quiel Honors Father-in-Law’s Dying Words in Bid to Sue Gov’t for $135,000,000 Over Abuse of Process, Malicious Prosecution, RICO and More.

By Ron Lee

Investigative Journalist

Michael Quiel

“You’ve got to fight them, Mike. I believe in you!” Those were Colonel John Lee’s last words, said to his son-in-law, Michael Quiel, regarding now proven to be false criminal charges Mike was facing. Colonel Lee knew Mike had to fight for his innocence, no matter what – that it was the only way for an innocent man to behave. According to Mike, his wife and Colonel Lee’s daughter, Victoria, had agreed with them both, that fighting was the right thing to do.

Now, over eleven years later, Mike is making good on his pledge to keep up the fight by filing a massive $135,000,000 civil lawsuit against the IRS, IRS agent Cheryl Bradley, Assistant United States Attorney (AUSA) Monica Edelstein (who is now a sitting judge in Arizona), AUSA Timothy Stockwell, Michael Quiel’s former tax attorney and legal advisor, Christopher Rusch (now known as Christian Reeves) and others known or unknown.

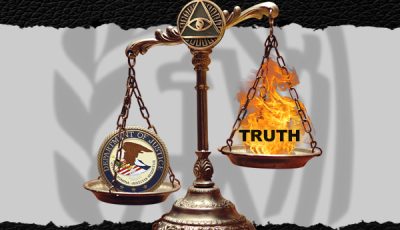

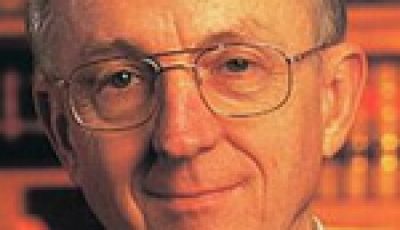

Ex-Prosecutor, Now Judge, Has No Immunity in Lawsuit

Monica Edelstein

A great many things can be said about Monica Edelstein. She is currently a Maricopa County Judge, presiding over family court. From 2006 to 2013, Edelstein was a trial attorney, for the Department of Justice (DOJ) in the Criminal Tax Division. Then from 2013 to 2020 she was an AUSA, based out of Phoenix, Arizona. And while her bio reads like she has done “good things” to get where she is, it is the definition of what those “good things” are that calls into question how honorable Monica Edelstein truly is.

Appearances are Edelstein had a stellar career as a prosecutor, but were her prosecutions truly warranted? Or, like many other prosecutors, were some of those she prosecuted just “lucky enough” to land in front of a driven, unrelenting force to prosecute at all costs – to hell with justice? Based on the US~Observer investigation into Michael Quiel’s false criminal tax conviction, Monica Edelstein absolutely didn’t care about justice, just convicting her target.

Since becoming a judge, the US~Observer has received numerous calls and emails about Judge Edelstein’s behavior in court proceedings. Complaints range from Edelstein favoring one party over another, regardless of evidence, to taking children from their parents without cause. In light of the fact that Edelstein falsely prosecuted Michael Quiel, these complaints are totally believable.

In the civil rights lawsuit filed by Michael Quiel, who defeated all but one of the now proven to be false charges against him, Edelstein’s involvement in creating an ironclad prosecution against him presumably meant she was involved in creating the sole testimony against him. That testimony came from Quiel’s own tax attorney – a man by the name of Christopher Rusch.

Rusch had “cut a deal” with Edelstein and or the IRS, but when asked about it by the presiding judge, Edelstein stated that she wasn’t aware of any deal. The truth of the matter is, Edelstein had to have known that a deal had been made with Rusch.

US~Observer’s Editor-in-Chief, Edward Snook, stated that Edelstein stepped outside of her prosecutorial immunity. He went on to say, “We defeated prosecutorial immunity in the James Faire murder case in Washington State, and I can tell you, our investigation has concluded Edelstein knew that Christopher Rusch was getting preferential treatment, and she lied to the court.”

According to Quiel’s lawsuit, he is suing Monica Edelstein in both her personal and professional capacity.

“I once heard a federal judge say that attorneys lie every day in court,” Michael Quiel somberly stated to Snook on a call. “I know they lied in my case and that’s what my civil suit is all about. They knew I was innocent, and they kept coming anyway. Now, I’m coming for them, because if we don’t have justice in my case, we end up having a pattern of falsely prosecuting other innocent individuals.”

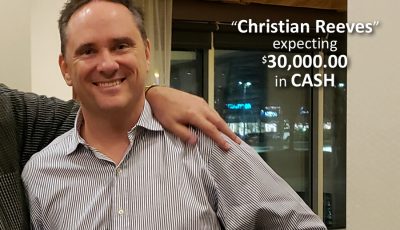

Christopher Rusch aka Christian Reeves

Ex-Tax Attorney Still Scheming

Christopher Rusch, after being disbarred in the State of California, conveniently changed his name to Christian Reeves so he could continue scamming innocent individuals out of their hard-earned money – all under the not-so-watchful eye of the entire “justice system”. In fact, Rusch/Reeves holds himself out to the prospective clients as an expert in expatriating, and in the “art” of offshore banking and investing.

Ex-Wife Now Lying in Court

Victoria Quiel

Unfortunately for Mike, Victoria has tapped out of the fight and their relationship, saying under oath in their recent divorce proceedings that she originally had wanted to settle with the IRS and not fight. This statement of hers is a direct contradiction to the statement quoted from Colonel John Lee from Michael Quiel’s book “Rigged”.

The suit filed in the United States District Court, District of Arizona on December 25, 2022, alleges Malicious Prosecution, Abuse of Process, Tortious Interference and RICO. It lays out evidence of collusion between government actors and Michael and Victoria’s attorney, Rusch/Reeves, all in an effort to convict Mike and his business partner for crimes that Rusch/Reeves was solely guilty of committing. It proves that prosecutors and Rusch/Reeves conspired to create testimony that would be used to convict Mike and his partner. The racketeering was done in an effort to adhere to the government’s agenda of prosecuting American’s who were using foreign banks as tax shelters, with, or in this case, without factual guilt.

The biggest evidence of Michael Quiel’s innocence was a $500,000.00 overpayment of tax refund check paid to Michael and Victoria by the IRS while he was being prosecuted for “trying to get out of paying taxes.” The jury rightly found Mike not guilty of conspiracy, and not guilty of FBAR violations, however, they wrongly found Mike guilty of filing false tax returns – keep in mind, Rusch/Reeves represented Michael and Victoria as their tax attorney, and they closely followed all of his advice.

It cost Michael his freedom for over ten months in prison and Michael and Victoria countless dollars fighting for his innocence prior to and since. Victoria’s prosecution was avoided as Mike acted as her shield. Michael worked for years and was finally able to get Victoria innocent spousal relief just months ago. Once Victoria’s spousal relief was in place she planned and then initiated divorce proceedings to end her marriage with Michael. Victoria has obviously opened herself up to great civil liability with the IRS as the civil end of their fight over taxes is still ongoing.

The US~Observer, who has extensively investigated Michael Quiel’s wrongful conviction, as well as Rusch/Reeves’ continued financial scams will continue to fight on behalf of Michael Quiel’s pursuit of vindication. Read the articles on our complete and concise coverage of Michael Quiel’s case at usobserver.com.

Michael Quiel deserves to have his day in court, and for the facts to be justly weighed.

Editor’s Note: Anyone with information on wrongdoing on the part of anyone named in this article is urged to contact the US~Observer at 541-474-7885 or by email to editor@usobserver.com.